Asset Protection Beyond the Value of Your Policy

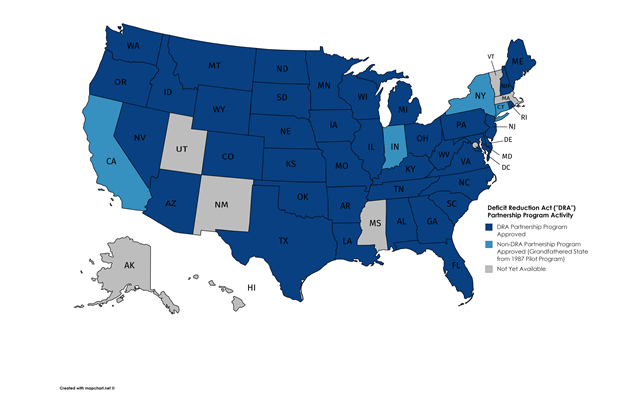

The implementation of the Deficit Reduction Act (DRA) in 2005 launched a massive new program nationwide called the "Partnership". Although not all states have passed the necessary enacting legislation even ten years later, around forty-five (45) have.

Like the name implies, Partnership combines the best of private LTC insurance with the backstop of a public guarantee. If your state participates in the DRA Partnership Program, you will definitely want to ask your LTC Insurance Specialist if a Partnership plan is right for you-- you may be able to purchase a smaller benefit than you were first considering. With the exception of the four states named below:

- A Partnership plan costs exactly the same as a non-Partnership plan

- The only requirement you must adhere to is purchasing a minimum level of inflation protection (based on your age, set by your state)

Here is the benefit of Partnership in a nutshell:

- In nearly all states, the maximum amount of countable assets you can retain and still qualify for Medicaid is $2,000.

- However, those who purchase Partnership-qualified long term care insurance are entitled to protect more assets.

- These individuals receive $1 of additional asset protection for each $1 the insurance company pays out in benefits, known as Dollar-for-Dollar asset protection.

- For example, if your LTC policy paid $300,000 in claims and you still needed to go on Medicaid, you could theoretically protect $302,000 in assets from both spend down and estate recovery.

- Note: Partnership plans protect only assets-- not income-- and you must still meet Medicaid's other eligibility criteria.

In order to sell Partnership-qualified plans, each LTCA Specialist has undergone state-required special training courses necessary to assist you. Although there are clear benefits, Partnership policies come with some important limitations. Please ask your agent for complete details.

Grandfathered Partnership States

If you live in California, Connecticut, Indiana or New York, different rules apply to you. These original states first piloted the Partnership program and have been allowed to retain much of their unique structure. For this reason, the four are sometimes called "grandfathered" states.

You can speak with an LTCA Specialist who is certified to provide detailed information regarding Partnership products in CA, CT, IN or NY.

This is a Deep Dive topic.

Click here to view a companion page containing additional in-depth information.